Payment Choice and Trust in Digital Gift Cards

Why offering both crypto payments and SEPA bank transfers builds real trust when buying digital gift cards, and how payment choice reduces friction at checkout.

Trust Comes First: Why Payment Choice Matters When Buying Digital Gift Cards

In digital commerce, trust is rarely built through slogans. It is built through structure, clarity, and the small decisions a platform allows its users to make. Nowhere is this more visible than at checkout. Before a user compares prices or delivery speed, there is a simpler, more decisive question running in the background: “Do I feel safe completing this payment here?”

Digital gift cards amplify this question. There is no shipping, no physical product, no waiting period. The value is delivered instantly, which makes confidence at the moment of payment essential. In this context, payment methods are not just technical rails. They are trust signals. They tell the user how transparent the platform is, how accountable it feels, and whether the brand is designed for the long term.

This is exactly why ACEB made a deliberate decision to offer two payment paths: crypto payments for users who value speed and direct control, and SEPA bank transfer for users who want maximum familiarity and reassurance on a first purchase. This is not about replacing one with the other. It is about letting trust grow naturally.

Payment Choice Is About Agency, Not Preference

Most ecommerce discussions frame payment methods as “preferences.” In reality, they are about agency. When a user reaches checkout, they want to feel that they are choosing how to pay, not being pushed into a single option that the platform prefers.

Agency reduces anxiety. It shifts the mindset from “Should I trust this site?” to “Which option fits me right now?” That shift is subtle, but powerful. It lowers friction without pressure, and it respects the fact that different users arrive with different levels of confidence.

For some users, crypto already feels natural. For others, especially on a first interaction with a new platform, a bank-native option creates a sense of grounding. Offering both is not a compromise. It is a trust architecture.

SEPA as a Trust Bridge, Not a Strategic Pivot

SEPA was added to ACEB for one core reason: trust. Not as a technical feature, and not as a signal that the platform is moving away from crypto. Quite the opposite. SEPA exists to remove hesitation for users who are not yet ready to use crypto, or who want to verify a platform through familiar financial infrastructure before committing.

For European users in particular, SEPA is part of everyday life. It feels verifiable. It feels accountable. It feels tied to a real company operating within a recognizable framework. That familiarity matters when the product itself is fully digital and delivered instantly.

At the same time, SEPA is intentionally positioned as a bridge. It allows first-time buyers to start in a way that feels safe, without closing the door to crypto as a cleaner, more efficient long-term habit once trust is established.

What This Looks Like in Practice

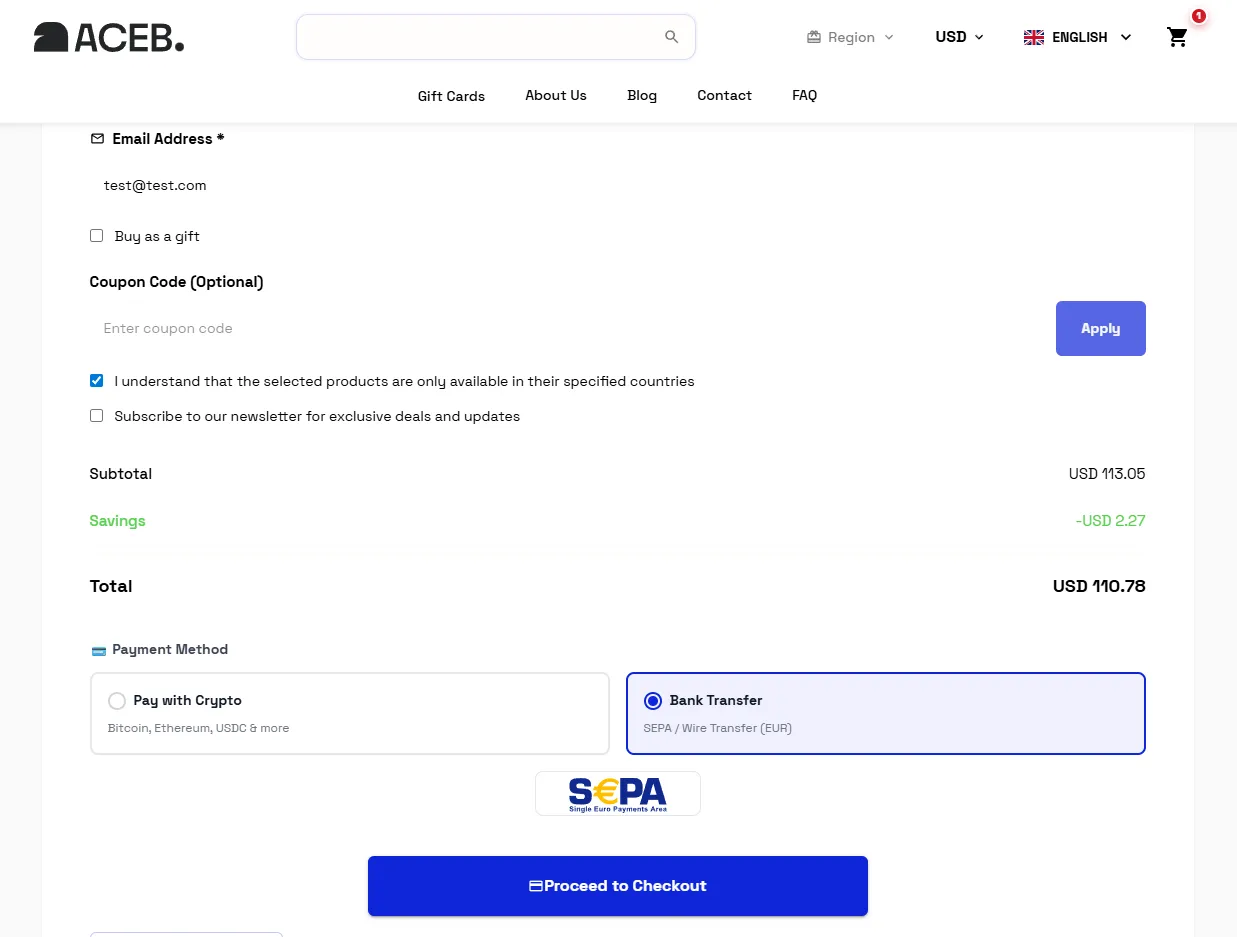

Instead of forcing users into a single checkout flow, ACEB makes the choice explicit. At the moment that matters most, users can decide how they want to proceed based on their own comfort level. This is not explained through marketing language. It is visible directly in the checkout experience.

Below is a real example from the ACEB checkout, showing how users can choose between paying with crypto or using a SEPA bank transfer. The goal is simple: transparency first, pressure last.

Why Digital Products Demand Higher Trust Signals

With physical goods, trust can be deferred. Shipping times, tracking numbers, and return policies create psychological buffers. Digital gift cards do not offer that buffer. The transaction is immediate, and so is the expectation.

This is why digital-first platforms need to be more intentional, not less. Every element of the checkout flow communicates something: how serious the company is, how transparent it wants to be, and whether it expects users to commit blindly or confidently.

Payment choice is one of the strongest signals in this equation because it sits at the exact moment of decision. It is where reassurance matters most.

Two Audiences, One Shared Concern

The addition of SEPA alongside crypto serves two distinct audiences, but solves the same underlying problem.

The first group consists of crypto users who understand digital payments perfectly well, but are cautious about where they send funds on a first interaction. Their hesitation is not about crypto itself. It is about platform legitimacy. Seeing a bank transfer option signals that the company is not hiding behind anonymity.

The second group consists of users who do not use crypto at all, or who are not ready to use it yet. They want access to digital gift cards, but through a payment method that feels familiar and verifiable. SEPA makes that possible without forcing them to adopt new tools on day one.

In both cases, the concern is the same: “Can I trust this platform?” Payment choice answers that question without needing to say it out loud.

Why Crypto Remains the Better Long-Term Choice

While SEPA plays a crucial role in building initial confidence, crypto remains the most natural long-term payment method for digital gift cards. It aligns with the nature of the product: digital value exchanged for instant digital access.

Crypto payments offer direct control, fewer intermediaries, and a cleaner transaction flow once the user is comfortable. For repeat buyers, this simplicity becomes a habit.

Trust Is Earned Through Options, Not Claims

Real trust comes from letting users act in ways that feel aligned with their own judgment. Payment choice does exactly that.

Where to Start

You can start on the ACEB homepage here: https://aceb.com